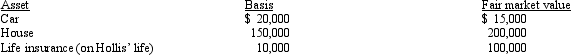

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Definitions:

Marginal Cost

The cost increase associated with the production of an extra unit of a product or service.

Market Price

The present cost at which a product or service is available for purchase or sale in the market.

Market Price

The current value at which a good or service can be bought or sold in a marketplace, influenced by supply and demand.

Profit-Maximizing

Refers to the process or strategy aimed at achieving the highest possible profit, where marginal cost equals marginal revenue.

Q51: The deduction for personal and dependency exemptions

Q54: Molly has generated general business credits over

Q55: Verway, Inc., has a 2012 net §

Q61: In the year of her death, Maria

Q78: Martha is single with one dependent and

Q83: Individuals with modified AGI of $100,000 can

Q84: Summer Corporation's business is international in scope

Q95: Lucy dies owning a passive activity with

Q97: Theresa and Oliver, married filing jointly, and

Q120: The required adjustment for AMT purposes for