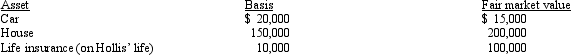

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Definitions:

Cost of Equity

The return that investors expect for investing in a company's equity, considering the risk of the investment.

Retained Earnings

The portion of a company's profits that is kept or retained for reinvestment in the business, rather than being paid out as dividends.

Retained Earnings

Portion of a company's profits that is kept or retained within the company, rather than paid out to shareholders as dividends, for reinvestment in the business or to pay off debt.

Opportunity Cost Principle

The opportunity cost principle denotes the value of the best alternative foregone when a decision is made to pursue a particular action.

Q9: Certain high-income individuals are subject to three

Q11: In January 2013, Pam, a calendar year

Q33: In 2012, Brandon, age 72, paid $3,000

Q69: Interest on a home equity loan may

Q77: Taxpayer owns a home in Atlanta.His company

Q80: A taxpayer is considered to be a

Q91: In 2012, José, a widower, sells land

Q118: Some states use their state income tax

Q147: Molly exchanges a small machine (adjusted basis

Q186: The holding period of nontaxable stock rights