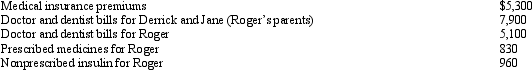

Roger is employed as an actuary.For calendar year 2012, he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Definitions:

8% Return

An investment objective or outcome where the investor aims to achieve an annual return of 8 percent on the invested principal.

Interest Rate

The percentage at which interest is paid by a borrower for the use of money that they borrow from a lender.

Annual Payment

A payment made once a year, often related to loans, insurance policies, or subscription services.

Investment

The allocation of resources, usually capital, in the expectation of generating an income, profit, or capital appreciation.

Q2: In 1997, the International Task Force on

Q3: What is a recommended procedure to elicit

Q13: In which of the following conditions is

Q22: David, a single taxpayer, took out a

Q23: Which of the following is true about

Q24: One of the motivations for making a

Q34: Jeanne had an accident while hiking on

Q71: In early July 2012, Gavin is audited

Q152: Which, if any, of the following provisions

Q165: The exchange of unimproved real property located