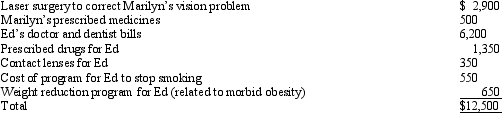

Marilyn, Ed's daughter who would otherwise qualify as his dependent, filed a joint return with her husband Henry. Ed, who had AGI of $150,000, incurred the following expenses:  Ed has a medical expense deduction of:

Ed has a medical expense deduction of:

Definitions:

Disparate Impact

A theory in employment and legal disputes where policies, practices, or rules seemingly neutral result in a disproportionate impact on a protected group.

Disparate Treatment

A legal term for when an employee is treated differently than others in the workplace based on protected characteristics, such as race or gender, which is illegal under employment law.

Title VII

A section of the Civil Rights Act of 1964 prohibiting employment discrimination based on race, color, religion, sex, or national origin.

Title VII

A provision in the Civil Rights Act of 1964 that forbids job discrimination on the grounds of race, color, religion, gender, or national origin.

Q5: Gabe's office building (adjusted basis of $430,000;

Q6: At about what age does an infant's

Q8: Using the choices provided below, show the

Q9: Why is the birth of a child

Q15: Which of the following is true about

Q39: Sarah, who owns a 50% interest in

Q84: Summer Corporation's business is international in scope

Q103: Any capital asset donated to a public

Q103: The basis of property acquired in a

Q128: Currently, the tax base for the Medicare