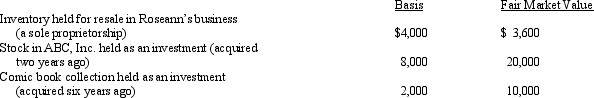

In 2012, Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church, and the comic book collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Roseann's charitable contribution deduction for 2012 is:

The ABC stock and the inventory were given to Roseann's church, and the comic book collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Roseann's charitable contribution deduction for 2012 is:

Definitions:

Alternative Combinations

Alternative combinations refer to different ways that resources can be allocated to produce varying outputs of goods and services in an economy.

Indifference Curve

A graphical representation showing combinations of two goods between which a consumer is indifferent, reflecting equal levels of utility.

Utility Analysis

An approach in economics that assesses the satisfaction or benefit a consumer receives from consuming goods or services.

Numerically Measurable

Characteristics or quantities that can be quantified or expressed using numbers.

Q14: During 2012, Kathy, who is self-employed, paid

Q42: Vail owns interests in a beauty salon,

Q61: The education tax credits (i.e., the American

Q66: Roger is considering making a $3,000 investment

Q68: Define qualified small business stock under §

Q69: The objective of pay-as-you-go (paygo) is to

Q77: Margaret, who is self-employed, paid $6,000 for

Q93: When determining whether an individual is a

Q129: If the taxpayer qualifies under § 1033

Q145: If the alternate valuation date is elected