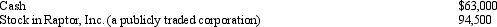

During 2012, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Definitions:

Average Fixed Cost

The fixed costs of production (costs that do not change with output) divided by the quantity of output produced, which decreases as production increases.

Total Costs

The aggregate financial expense incurred in the production of goods or services, including both fixed and variable costs.

Average Fixed Costs

Production's steady costs, unchanged by the amount of production, divided across the output quantity.

Total Variable Costs

The overall expenses that vary directly with the level of production output, such as raw materials and labor.

Q8: In normal speech, what is the primary

Q13: Charles, who is single, had AGI of

Q21: Susan generated $55,000 of net earnings from

Q23: Which of the following best describes cul-de-sac

Q54: If fraud is involved, there is no

Q90: The ratification of the Sixteenth Amendment to

Q94: Matt, a calendar year taxpayer, pays $11,000

Q106: If a taxpayer files early (i.e., before

Q119: Fran was transferred from Phoenix to Atlanta.She

Q142: A state income tax can be imposed