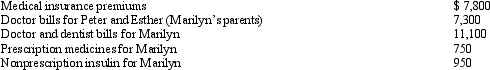

Marilyn is employed as an architect.For calendar year 2012, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Definitions:

Commitments

Obligations or pledges to do something, often implying a promise made to others or oneself.

Impression Management

The process by which individuals attempt to control the perceptions others have of them.

Phony

Not genuine; fake or deceitful in character or behavior.

Selective Perception

The tendency to define problems from one’s own point of view.

Q6: The earliest that a pharyngoplasty is usually

Q7: Kim dies owning a passive activity with

Q7: Infants with an unrepaired cleft palate demonstrate

Q12: Which of the following cannot be determined

Q15: Which of the following tests allows the

Q28: Virtually all state income tax returns contain

Q65: Compare civil fraud with criminal fraud with

Q88: The taxpayer owns stock with an adjusted

Q97: Allowing a domestic production activities deduction for

Q124: Indicate which, if any, statement is incorrect.State