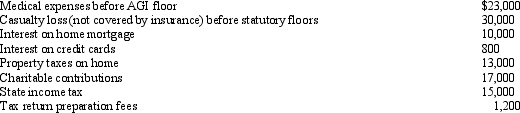

For calendar year 2012, Jon and Betty Hansen file a joint return reflecting AGI of $280,000.They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

What is the amount of itemized deductions the Hansens may claim?

Definitions:

Psychographics

The study of personality, values, opinions, attitudes, interests, and lifestyles to analyze consumer behavior.

Consumer Lifestyles

The habits, attitudes, tastes, moral standards, economic levels, and the amount of consumption by an individual or group.

Ideals

Standards or models of perfection and excellence that individuals or societies strive to achieve.

Principles

Fundamental truths or propositions that serve as the foundation for a system of belief or behavior or for a chain of reasoning.

Q5: To estimate velopharyngeal orifice size, which of

Q10: What does the orifice equation use to

Q13: Which of the following occurs when one

Q19: The tax law provides various tax credits,

Q32: Jed spends 32 hours a week, 50

Q45: The amount of a corporate distribution qualifying

Q49: Chris receives a gift of a passive

Q59: In 2012, Arnold invests $80,000 for a

Q65: In 2012 Michelle, single, paid $2,500 interest

Q119: To lessen, or eliminate, the effect of