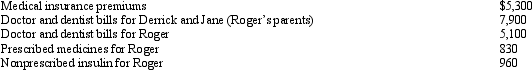

Roger is employed as an actuary.For calendar year 2012, he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Definitions:

Market Share

The portion of a market controlled by a particular company or product.

Revenue

The total amount of money generated by a company from its business activities, such as sales of goods or services, before any expenses are subtracted.

Price-Taker Market

A market situation where sellers or buyers have no influence on the price of a product or service, taking the market price as given.

Market Price

The current price at which a good or service can be bought or sold on the open market, determined by the forces of supply and demand.

Q2: Using the following choices, fill in

Q14: What phoneme is best to use when

Q17: Bruce owns a small apartment building that

Q22: The holding period for property acquired by

Q35: Your friend Scotty informs you that he

Q63: Owen and Polly have been married for

Q69: Any unused general business credit must be

Q78: Stan, a computer lab manager, earns a

Q79: In October 2012, Ben and Jerry exchange

Q104: Which of the following is correct?<br>A)The gain