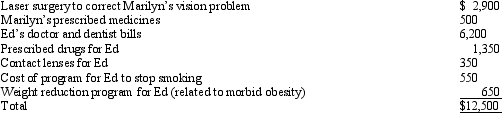

Marilyn, Ed's daughter who would otherwise qualify as his dependent, filed a joint return with her husband Henry. Ed, who had AGI of $150,000, incurred the following expenses:  Ed has a medical expense deduction of:

Ed has a medical expense deduction of:

Definitions:

Commodity

A basic good used in commerce that is interchangeable with other goods of the same type.

Tax

a financial charge or other levy imposed upon a taxpayer by a governmental organization in order to fund public expenditures.

Tax Avoidance

The legal practice of arranging one's financial affairs to minimize tax liability within the law.

Tax Evasion

The illegal practice of not paying taxes by individuals or corporations through various methods, including underreporting income.

Q7: Infants with an unrepaired cleft palate demonstrate

Q25: Which of the following groups of sounds

Q40: The basis of personal use property converted

Q49: Chris receives a gift of a passive

Q60: Sadie mailed a check for $2,200 to

Q61: The education tax credits (i.e., the American

Q107: The components of the general business credit

Q107: Jason's business warehouse is destroyed by fire.As

Q145: Using the choices provided below, show the

Q173: Betty owns a horse farm with 500