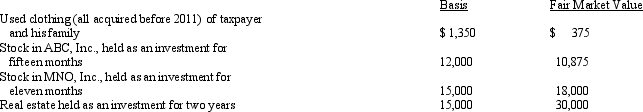

Zeke made the following donations to qualified charitable organizations during 2012:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for 2012 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for 2012 is:

Definitions:

Capacity Alternatives

Options or strategies an organization can employ to adjust its capacity to meet changing demand.

Market Acceptance

The degree to which a new product, service, or idea is embraced and adopted by the target market or customers.

Capacity

The maximum amount or number that can be received or contained, commonly used in reference to production and manufacturing capabilities.

Utilization

The proportion of the available time that a system, machine, or service is operating or being used.

Q3: Which of the following statements is true?<br>A)The

Q4: When feeding an infant, a general rule

Q5: Upon examination, the child demonstrates the use

Q16: The tax law allows, under certain conditions,

Q45: Ahmad owns four activities. He participated for

Q46: One of the major reasons for the

Q73: When interest is charged on a deficiency,

Q78: Phyllis, a calendar year cash basis taxpayer

Q81: Rosie owned stock in Acme Corporation that

Q180: If the fair market value of the