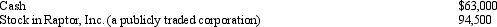

During 2012, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Definitions:

Independence

The state of being free from the control or influence of others, capable of thinking or acting for oneself.

Behavior Problems

Actions or patterns of behavior that are socially disruptive or inappropriate for a person's age or environment.

Self-Esteem

An individual's subjective evaluation of their own worth, encompassing beliefs about oneself as well as emotional states.

Social Status

The position or rank of a person or group within the society based on various factors, including wealth, occupation, education, and family lineage.

Q1: The team's primary contact person for the

Q3: If a child is orally reading a

Q7: Which of the following is a common

Q11: Which of the following is not an

Q17: What type of resonance disorder occurs due

Q28: Cassie purchases a sole proprietorship for $145,000.The

Q30: Gerald, a physically handicapped individual, pays $9,000

Q54: Services performed by an employee are treated

Q86: Identify how the passive loss rules broadly

Q159: Under a state inheritance tax, two heirs,