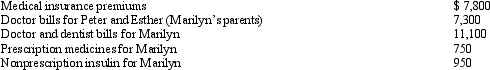

Marilyn is employed as an architect.For calendar year 2012, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Definitions:

Educational Quality

The measure of the effectiveness, efficiency, and equity of education in meeting the learning or educational needs of students.

Child-Centered Program

An educational approach that focuses on the individual child's needs, interests, and developmental stage rather than on predetermined curriculum standards.

Preschool

An educational establishment or learning environment for children typically between the ages of 3 and 5, prior to the start of compulsory education at primary school.

Q1: Breastfeeding is more likely to be possible

Q1: At what ages is the facial skeleton

Q2: Which of the following typically causes a

Q3: Mary Jane participates for 100 hours during

Q10: Nora acquired passive activity A several years

Q10: What does the orifice equation use to

Q13: In which of the following conditions is

Q26: Kevin purchased 5,000 shares of Purple Corporation

Q51: All taxpayers are eligible to take the

Q70: Iva owns Mauve, Inc.stock (adjusted basis of