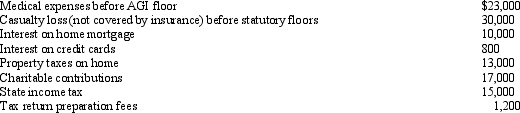

For calendar year 2012, Jon and Betty Hansen file a joint return reflecting AGI of $280,000.They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

What is the amount of itemized deductions the Hansens may claim?

Definitions:

Myocardial Infarction

The event of heart tissue damage due to restricted blood flow, leading to chest pain and potential cardiac arrest, also known as a heart attack.

Tachycardia

A condition characterized by an abnormally fast heart rate, usually defined as exceeding 100 beats per minute in adults.

Angina Pectoris

A condition marked by severe chest pain due to insufficient blood supply to the heart, often a symptom of coronary artery disease.

To Choke

To experience difficulty breathing because of a constricted or obstructed throat or lack of air.

Q5: How many teeth do children have? How

Q9: Tara owns a shoe store and a

Q10: Broker's commissions, legal fees, and points paid

Q10: When doing nasopharyngoscopy procedure, what is the

Q23: Which of the following best describes cul-de-sac

Q36: In 2012, Boris pays a $3,800 premium

Q61: Using the choices provided below, show the

Q77: Samantha sells a passive activity (adjusted basis

Q99: Timothy suffers from heart problems and, upon

Q153: If the tax deficiency is attributable to