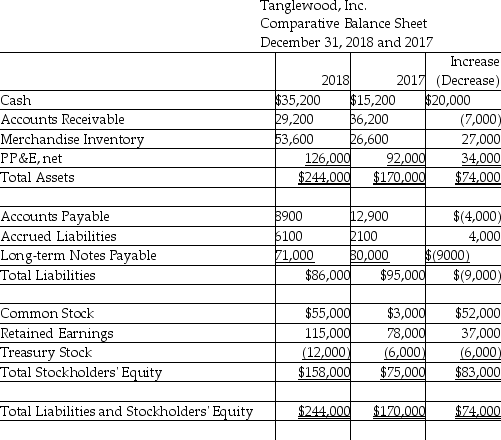

Tanglewood, Inc. uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ended December 31, 2018:  Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses. (Accrued Liabilities relate to other operating expense.)

Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses. (Accrued Liabilities relate to other operating expense.)

Definitions:

Corporate Bond

A debt security issued by a corporation to raise funding, which promises to pay back with interest.

Annuities

Financial products that provide a stream of payments over time to the holder, often used for retirement purposes.

Retirement Years

The period of life after one ceases working full time based on achieving a certain age or financial status.

Annual Return

The percentage change in an investment's value over a one-year period, including any dividends or interest, reflecting the compound annual growth rate.

Q27: Which of the following would be considered

Q51: On March 21, 2019, the bond accounts

Q67: On May 1, 2018, Plumbing Services issued

Q89: The process for calculating present values is

Q95: When 1000 shares of $3 stated value

Q107: The current ratio may indicate that the

Q182: Manley Corporation issued 2,500 shares of its

Q184: O'Malley, Inc. issued 60,000 shares of common

Q254: Which of the following statements is true?<br>A)

Q271: If a company retires preferred stock, _.<br>A)