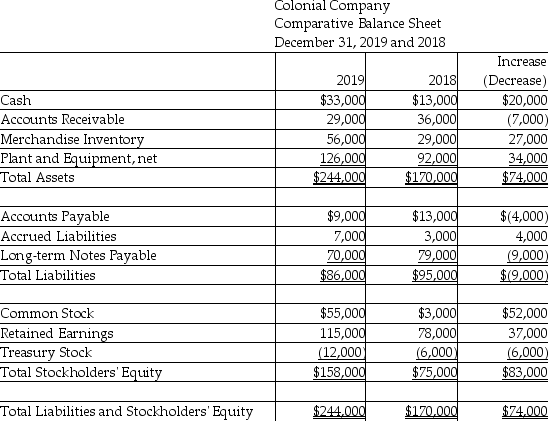

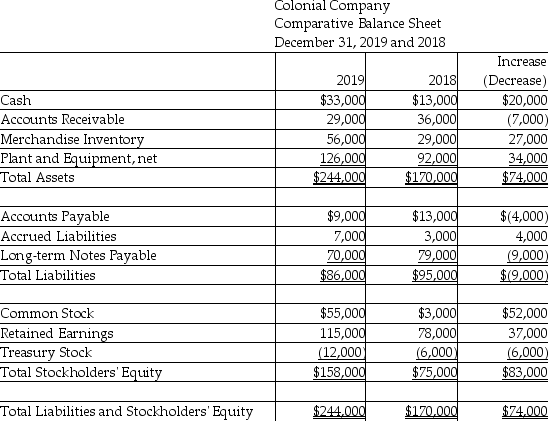

Colonial Company uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ending December 31, 2019:

Colonial CompanyIncome Statement Year Ended December 31, 2019 Sales Revenue Interest Revenue Gain on Sale of Plant Assets Total Revenues and Gains Cost of Goods Sold Salaries and Wages Expense Depreciation Expense - Plant Assets Other Operating Expense Interest Expense Income Tax Expense Total Expenses Net Income $291,3001,0006,000145,00049,00016,00025,0003,5007,800$298,300246,300$52,000 Colonial CompanyStatement of Retained Earnings Year Ended December 31, 2019 Retained Earnings, January 1,2019 Add: Net income Less: Dividends Retained Earnings, December 31,2019$78,00052,00015,000$115,000 Prepare the operating activities section of the statement of cash flows, using the direct method. Accrued liabilities relate to other operating expenses.

Colonial CompanyIncome Statement Year Ended December 31, 2019 Sales Revenue Interest Revenue Gain on Sale of Plant Assets Total Revenues and Gains Cost of Goods Sold Salaries and Wages Expense Depreciation Expense - Plant Assets Other Operating Expense Interest Expense Income Tax Expense Total Expenses Net Income $291,3001,0006,000145,00049,00016,00025,0003,5007,800$298,300246,300$52,000 Colonial CompanyStatement of Retained Earnings Year Ended December 31, 2019 Retained Earnings, January 1,2019 Add: Net income Less: Dividends Retained Earnings, December 31,2019$78,00052,00015,000$115,000 Prepare the operating activities section of the statement of cash flows, using the direct method. Accrued liabilities relate to other operating expenses.

Understand concepts related to personal income, such as average vs. transitory income and the economic life cycle.

Understand the concepts of economic mobility and the factors influencing it in the United States.

Grasp the methodology behind setting and understanding the poverty line.

Describe the determination and implications of the poverty rate.

Definitions:

Neutral Stance

An unbiased or impartial position or viewpoint not favoring either side in a dispute or debate.

Activities

Actions or tasks performed by individuals or groups, often with a specific objective or purpose in mind.

Unrelated Business Income

Income generated from activities that are not directly related to an organization's primary mission, of particular concern for nonprofits maintaining tax-exempt status.

Forms 990

The IRS forms required to be filed by nonprofit organizations in the United States, providing the public with financial information about the nonprofit's operations.

Prepare the operating activities section of the statement of cash flows, using the direct method. Accrued liabilities relate to other operating expenses.

Prepare the operating activities section of the statement of cash flows, using the direct method. Accrued liabilities relate to other operating expenses.