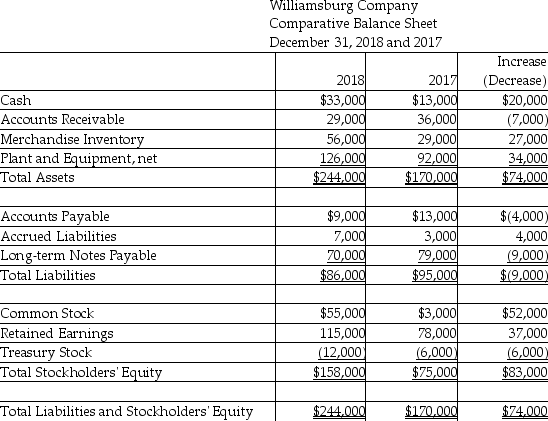

Williamsburg Company uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ending December 31, 2018:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

During 2018, the company repaid $43,000 of long-term notes payable.

During 2018, the company borrowed $34,000 on a new note payable.

There were no stock retirements during the year.

There were no sales of Treasury Stock during the year.

Prepare a complete statement of cash flows using the direct method.

Accrued Liabilities relate to other operating expenses.

Definitions:

Allowance Method

An approach in accounting that calculates expected losses from bad debts by assessing uncollectible accounts at the conclusion of each period.

Estimated Bad Debts

A provision in accounting for the amount of receivables that are expected not to be collected, considered an expense.

Accounts Receivable Turnover

A financial ratio indicating how many times a company's receivables are turned over during a period.

Specific Accounts

Refers to accounts designated for specific purposes or transactions, distinguishing them from general or combined accounts.

Q3: Which of the following transactions would be

Q17: Dental, Inc. uses the direct method

Q24: Which of the following corporate characteristics is

Q52: Define period cost. Give three examples of

Q71: Which of the following would be classified

Q93: Using the effective-interest amortization method, the amount

Q124: Lightning Electric Company uses the direct method

Q132: For a manufacturing company, which of the

Q153: Which of the following would be included

Q267: The declaration of a stock dividend creates