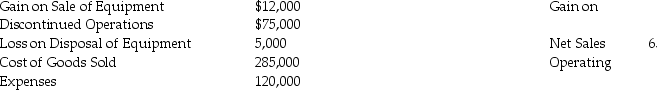

Adams Corporation's accounting records include the following items for the year ending December 31, 2019:

The income tax rate for the company is 25%. Prepare Adams' multi-step income statement for the year ended December 31, 2019. Omit earnings per share.

The income tax rate for the company is 25%. Prepare Adams' multi-step income statement for the year ended December 31, 2019. Omit earnings per share.

Definitions:

Chain of Distribution

The sequence of intermediaries through which a product or service passes until it reaches the end consumer.

Competitors

Individuals or entities that are in the same industry or market and vying for the same customers or market share.

Robinson-Patman Act

A United States federal law that prohibits anticompetitive practices by producers, specifically price discrimination.

Cost Savings

A reduction in expenses, achieving the same outcomes but at a lower cost.

Q12: The change in cash is the key

Q13: <br> <span class="ql-formula" data-value="\begin{array} {

Q37: The matching principle requires businesses to report

Q53: On January 1, 2019, Eastern Services

Q69: Unearned revenue, for services to be performed

Q89: Employer FICA tax is paid by the

Q93: On November 1, 2019, Juno, Inc. declared

Q121: Regarding the profit margin ratio, which of

Q143: The journal entry for the purchase of

Q147: Oregon Company is preparing its statement of