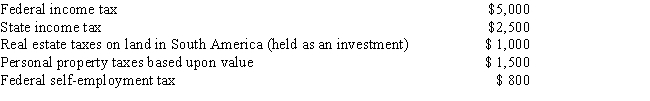

During the current year, Seth, a self-employed individual, paid the following taxes: What amount can Seth claim as an itemized deduction for taxes paid during the current year, assuming he elects to deduct state and local income taxes?

Definitions:

Real Rate

The interest rate adjusted for inflation, reflecting the true cost of borrowing or the true return on investment.

Nominal Rate

The interest rate before adjustments for inflation, as opposed to the real rate, which is adjusted for inflation.

Rate of Inflation

The percent change in the price level of goods and services in an economy over a period of time, usually measured annually.

Interest

Interest is the charge for borrowing money typically expressed as an annual percentage rate, or the income earned from lending money.

Q6: Federal Supplementary Education Opportunity Grants are for

Q18: In practice, most clients ask their personal

Q25: Donald, a 40-year-old married taxpayer, has a

Q26: Which of the following statements is accurate?<br>A)

Q27: Which of the following is not a

Q33: Which of the following statements is true

Q47: Assuming a taxpayer has no other gains

Q50: Unemployment compensation is fully taxable to the

Q96: Simonne, a single taxpayer, bought her home

Q100: Interest earned on bonds issued by a