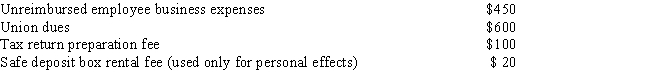

Peter is a plumber employed by a major contracting firm. During the current year, he paid the following miscellaneous expenses: If Peter were to itemize his deductions for the current year, what amount could he claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

Definitions:

Consciousness

The awareness of one's own existence, sensations, thoughts, and surroundings.

Observable Behavior

Measurable actions or responses in individuals that can be visually witnessed and recorded by others.

Inferiority

A psychological condition or feeling where an individual perceives themselves as lacking in ability, quality, or status compared to others.

Psychoanalysis

A therapeutic approach and theory of psychological disorders, pioneered by Sigmund Freud, that emphasizes unconscious conflicts and past experiences.

Q20: During 2016, William sold the following capital

Q21: If a taxpayer takes a trip within

Q24: If land declines in value, it may

Q25: ABC Corp bought a production machine on

Q31: What is the third step of the

Q39: Explain the use of the half-year convention

Q48: Distinguish between reporting entities and taxable entities

Q52: For purposes of taxation of capital gains:<br>A)Short-term

Q91: Which of the following assets is not

Q106: Teachers at the kindergarten through high school