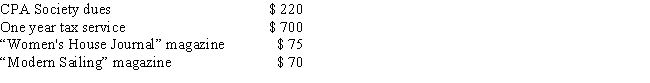

Catherine is a CPA employed by a large accounting firm in San Francisco. In the current year, she paid the following amounts: How much may she deduct on Schedule A as a miscellaneous deduction, before considering the 2 percent of adjusted gross income limitation?

Definitions:

Marketing Manager

A professional responsible for overseeing and guiding the marketing activities within an organization, including strategy, planning, execution, and analysis.

Luscious Chocolate Company

Luscious Chocolate Company could denote a hypothetical or real business specializing in the creation and sale of high-quality chocolate products, aimed at providing an indulgent experience for consumers.

Marketing Plan

A comprehensive document or blueprint that outlines a company's advertising and marketing efforts for the coming period.

Control Phase

The stage in a process where measures are applied to monitor and adjust the system's performance to ensure that it meets predetermined goals.

Q8: Amounts received by an employee as reimbursement

Q9: Which of the following is nontaxable income

Q26: Why is it so difficult to identify

Q29: Roger is required under a 2010 divorce

Q31: Sam died on January 15, 2006 and

Q33: Sales of property at a gain may

Q64: Helga receives a $300,000 life insurance payment

Q70: Choose the correct statement.<br>A)Residential real property is

Q75: Indicate whether each item below would be

Q102: Curt and Linda were married on December