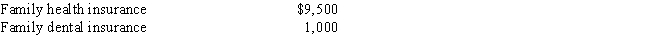

Mike and Rose are married and file jointly. Mike earns $45,000 from wages and Rose reports $450 on her Schedule C as an artist. Since Mike's work does not offer health insurance, Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Definitions:

Total Stockholders' Equity

The total amount of assets remaining in a company after all liabilities have been subtracted, representing the ownership interest of the shareholders.

Common Stock

Shares representing ownership in a corporation, giving holders voting rights and a share in the company's profits through dividends.

Price-Earnings Ratio

A valuation ratio of a company's current share price compared to its per-share earnings, used to evaluate whether a stock is over or undervalued.

Total Common Stock

The total value or number of common shares issued by a company, representing ownership interests.

Q1: Which of the following statements is false

Q4: Planning for yourself and others while you

Q12: Karen is single with no dependents and

Q13: Depreciation is the process of allocating the

Q16: Sam operates a manufacturing company as a

Q39: If the following are capital assets, mark

Q39: Jerry and Sally were divorced under an

Q57: Mary is self-employed for 2016. Mary estimates

Q69: Most states are community property states.

Q103: When calculating the exclusion ratio for an