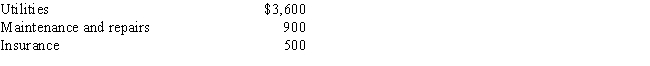

Bill is the owner of a house with two identical apartments. He resides in one apartment and rents the other apartment to a tenant. The tenant made timely monthly rental payments of $550 per month for the months of January through December 2016. The following expenses were incurred on the entire building: In addition, depreciation allocable to the rented apartment is $1,500. What amount should Bill report as net rental income for 2016?

Definitions:

Cognitive Processes

Mental actions or operations that include thinking, reasoning, problem-solving, decision-making, and memory.

Associative Learning

A learning process where a relationship is formed between two stimuli or between a stimulus and a behavior.

Negative Reinforcement

A method in behavioral psychology that increases the likelihood of a behavior by removing an unpleasant stimulus when the behavior occurs.

Discrimination

Biased or unfair behavior towards various groups of individuals, particularly based on their racial background, age, or gender.

Q2: Capital is best defined as:<br>A) The places

Q3: Jack is a lawyer who is a

Q9: Which of the following is nontaxable income

Q23: If taxpayers fail to provide their bank

Q51: A taxpayer eligible to use the installment

Q62: Jerry bought his home 15 years ago

Q69: Mortgage interest on a taxpayer's personal residence

Q88: Which of the following sales results in

Q90: If a loss from sale or exchange

Q105: What income tax form does a self-employed