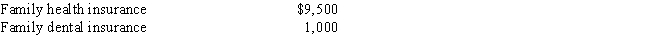

Mike and Rose are married and file jointly. Mike earns $45,000 from wages and Rose reports $450 on her Schedule C as an artist. Since Mike's work does not offer health insurance, Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Definitions:

Durable Good

A type of good that does not quickly wear out and is used over a long period, such as appliances, cars, or furniture.

Consumer Product

A product intended for personal use or consumption by the general public, as opposed to products designed for industrial or commercial use.

Business Product

Goods or services that are sold primarily to other businesses for use in production, resale, or operational purposes, rather than to the ultimate consumer.

Shopping Product

A type of product that consumers spend considerable time and effort in gathering information and comparing alternatives before making a purchase.

Q3: Child support payments<br>A)Included<br>B)Excluded

Q10: Taxpayers with large amounts of deductions may

Q15: Joey is a single taxpayer. Joey's employer

Q17: In 2016, Willow Corporation had three employees.

Q26: Outline the origins of personal financial planning.

Q38: A taxpayer made estimated tax payments in

Q39: A dependent child with earned income in

Q43: Which of the following is not deductible

Q49: If a taxpayer holding EE bonds makes

Q104: Karl's father, Vronsky, is a 60-year-old Russian