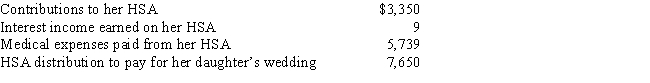

Miki, who is single and 57 years old, has a quaifying high-deductible insurance plan. She had the following transactions with her HSA during the year:

a.How much may Miki claim as a deduction for adjusted gross income?

b.What is the amount that Miki must report on her federal income tax return as income from her HSA?

c.How much is subject to a penalty? What is the penalty percentage?

Definitions:

Liability Insurance

A type of insurance that provides protection against claims resulting from injuries and damage to people or property.

Losses

Financial or material reductions resulting from business activities or other endeavors.

Negligence

Failure to take reasonable care to avoid causing injury or loss to another person.

Insurer

An entity that provides insurance policies to individuals or organizations, offering financial protection against losses from specified risks.

Q3: On June 1, 2016, Cork Oak Corporation

Q43: If an employee is transferred to a

Q43: If a Section 401(k) plan allows an

Q45: Taxpayers may expense the cost of depreciable

Q48: The interest paid on a loan used

Q58: Countryside Acres Apartment Complex had the following

Q62: List three different ways that a tax

Q80: Depreciation on property in the five-year MACRS

Q101: Unreimbursed employee business expenses are miscellaneous itemized

Q113: If a per diem method is not