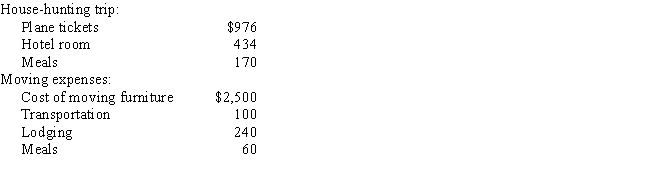

Gary and Charlotte incurred the following expenses in connection with Gary's job transfer from Florida to South Carolina:

How much is their qualified moving expense?

Definitions:

Compounded Semiannually

The process of applying interest to both the initial principal and accumulated interest over two periods within a year.

Present Value

The valuation today of a future financial sum or series of cash movements, taking into account a predetermined return rate.

Future Value

The estimated value of a current asset or amount of money at a specified date in the future, taking into account factors like interest rates or stock growth.

Present Value

The present-day valuation of a future sum of money or cash flow series, assuming a particular rate of earnings.

Q17: In 2016, what rate would a taxpayer

Q24: Inheritances<br>A)Included<br>B)Excluded

Q34: Russell purchased a house 1 year ago

Q35: Mr. and Mrs. Vonce, both age 62,

Q37: Redford's salary was $124,000 in 2016. What

Q69: Dividends paid to a shareholder by a

Q77: Amy is a calendar year taxpayer reporting

Q95: Meade paid $5,000 of state income taxes

Q106: All of the following amounts must be

Q110: Life insurance proceeds received upon the death