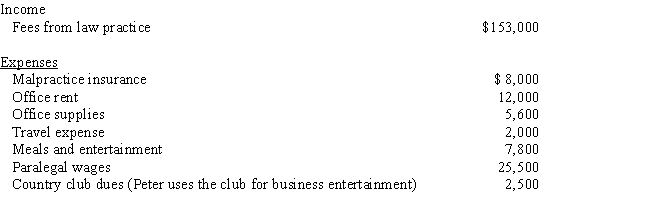

Peter is a self-employed attorney. He gives the following information about his business to his CPA for use in preparing his 2016 tax return:

Peter also drove his car 5,528 miles for business and used the standard mileage method for computing transportation costs. How much will Peter show on his Schedule C for 2016 for:

a.Income

b.Tax deductible expenses

c.Taxable income

Definitions:

Personality Traits

Enduring characteristics that describe an individual's behavior, such as introversion or extroversion, consistently observed across various situations.

Physical Health

The overall condition of an individual's body, including the absence of disease and the fitness level.

Social Network

A structure made up of individuals or organizations that are connected by one or more specific types of interdependency, such as friendship, kinship, common interest, or social activities.

Elderly Americans

Individuals living in the United States who are considered to be of old age, typically 65 years and older, with specific social, economic, and healthcare needs.

Q6: If a taxpayer receives an early distribution

Q14: Once a taxpayer uses the standard mileage

Q15: A credit against the FUTA tax is

Q28: During 2016, Howard maintained his home in

Q29: Roger is required under a 2010 divorce

Q44: Which of the following is not a

Q66: Generally, cash basis taxpayers must account for

Q95: Amended individual returns are filed on:<br>A)Form 1040X<br>B)Form

Q106: Jean's employer has an accountable plan for

Q117: Elmore receives a rental property as an