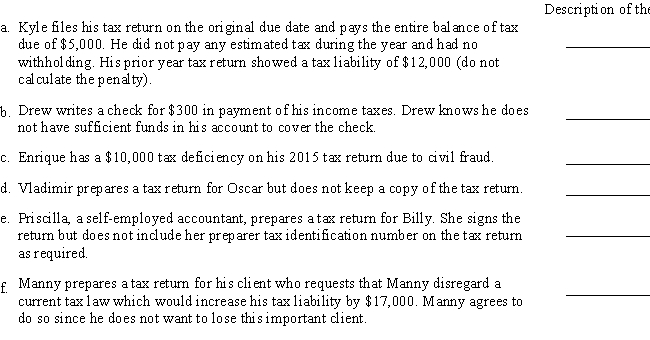

For each of the following situations, indicate the nature and amount of the penalty that could be imposed. (The penalties include both tax practitioner penalties and taxpayer penalties).

Definitions:

Total Product Curve

A graphical representation showing how the total quantity of output produced by a firm varies with the quantity of a variable input, keeping all other inputs constant.

Average Product

The output per unit of input, such as the quantity of goods produced per unit of labor.

Diminishing Returns

An economic principle stating that as investment in a particular area increases, the rate of profit from that investment, after a certain point, cannot continue to increase and may decrease.

Labor Input

The amount of work contributed by employees, measured in hours or effort, used in the production of goods and services.

Q8: Candace uses an office in her home

Q12: Prepare the necessary general journal entry for

Q26: Barbara receives a current distribution consisting of

Q40: The liability account used to record sales

Q45: Splashy Fish Store allows qualified customers to

Q60: List three things that a preparer needs

Q89: If Wages and Salaries Payable is debited,

Q89: The IRS has approved only two per

Q95: The net operating loss (NOL) provisions of

Q121: Unlimited Materials sold goods for $2,000 plus