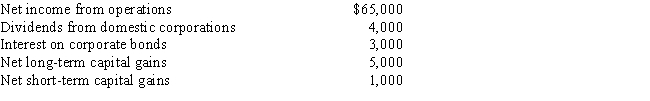

The partnership of Truman and Hanover realized the following items of income during the year ended December 31, 2016: Both the partners are on a calendar year basis. What is the total income which should be reported as ordinary income from business activities of the partnership for 2016?

Definitions:

Credit Hours

Units of academic credit that reflect the number of hours a student has engaged with a course each week over a semester.

Financial Aid

Assistance provided to students in the form of scholarships, grants, loans, or work-study programs, intended to support their education expenses.

Financial Aid

Monetary support intended to help students pay for educational expenses such as tuition, room and board, books, and fees.

Every Year

Occurring once annually; used to describe events or processes that happen or are required at intervals of one calendar year.

Q1: Kate's earnings during the month of May

Q3: George, age 67, and Linda, age 60,

Q9: Clark, a widower, maintains a household for

Q21: The statute of limitations for the deduction

Q31: Tim loaned a friend $4,000 to buy

Q45: Splashy Fish Store allows qualified customers to

Q54: A distribution of cash to a partner

Q63: Employees must receive W-3s by January 31

Q72: Is it correct to state that the

Q118: Sally is a high school math teacher.