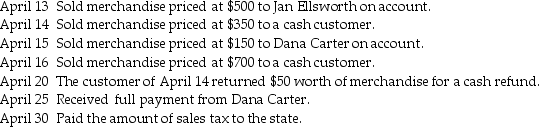

The Dairy Co. had the following transactions involving the sale of merchandise. You are to prepare the necessary general journal entries. All sales are subject to a 6% sales tax.

-Prepare the necessary general journal entry for April 20.

Definitions:

Security of Records

Measures put in place to protect records, both physical and electronic, from unauthorized access, theft, or damage.

Compliance Officers

Professionals responsible for ensuring that organizations adhere to legal standards and internal policies.

Indigents

Individuals lacking in basic resources such as food, clothing, and shelter due to poverty.

Social Security Amendments

Changes or modifications made to the laws governing social security, aimed at updating, improving, or expanding benefits provided to citizens.

Q17: Which form contains information about gross earnings

Q27: From the following accounts, prepare in proper

Q39: The income of an S corporation is

Q45: The accumulated earnings tax, which is imposed

Q51: An S corporation files a Form 1120S.

Q71: Internal control over a company's assets should

Q73: List the various steps and procedures included

Q85: Which of the following accounts should not

Q103: Prepare the necessary general journal entry for

Q120: Which taxes are considered 941 taxes?<br>A)FICA, FUTA,