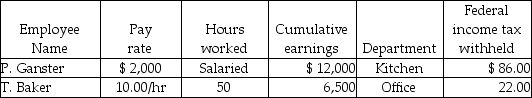

Grammy's Bakery had the following information for the pay period ending June 30:  Assume:

Assume:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Office Salaries Expense?

Definitions:

Countercyclical Stock

A type of stock whose performance is inversely related to the overall economic cycle, often performing better during economic downturns.

Expected Return

It represents the weighted average of all possible returns from an investment, considering the probabilities of each outcome.

Beta

A measure of a stock's volatility in relation to the overall market; indicating the relative risk associated with investing in the stock.

Q17: Tax returns selected for most audits are

Q22: If a corporation's status as an S

Q29: Electronic filing (e-filing):<br>A)Reduces the chances that the

Q30: The payroll tax expense is recorded at

Q37: Prepare journal entries for the following petty

Q50: Tim's Electrical Service purchased tools for $4,000.

Q77: Patricia and Cliff are married but file

Q85: Which of the following statements is false?<br>A)Payroll

Q85: _ Replenishment of petty cash

Q113: Why are the employee deductions recorded as