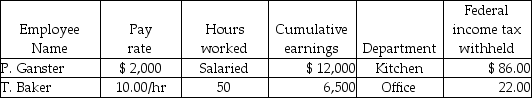

Grammy's Bakery had the following information for the pay period ending June 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

Definitions:

Secondary Circular Reactions

A developmental stage in infants where they repeat actions that affect their environment, showing an early understanding of cause and effect.

Bounded

Being enclosed within specific limits or boundaries.

Unitary

Pertaining to being a single or unified entity without division, often used in different contexts to denote oneness or singleness.

Separation

The process or state of being apart from something or someone, often used to describe the emotional process of detaching from a person, place, or thing.

Q6: Glen and Mary have two children, Chad,

Q7: Medeco sold goods for $100 to a

Q7: The May bank statement for Accounting Services

Q28: Which of the following types of income

Q51: An S corporation files a Form 1120S.

Q54: Workers' compensation:<br>A)insures employees against losses they may

Q74: Determine the reconciled bank balance given the

Q86: Prepare the necessary general journal entry for

Q105: Vicky is a single, 21 year-old, full-time

Q108: Income Summary does not have a normal