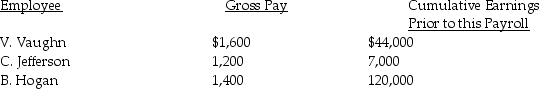

Using the information provided below, prepare a journal entry to record the payroll tax expense for Mr. B's Carpentry.

Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State unemployment tax rate is 2% on the first $7,000

Federal unemployment tax rate is 0.8% on the first $7,000.

Definitions:

Discharge a Contract

The termination of a contractual obligation, either through fulfillment of the contract terms, mutual agreement, or other legal means.

Material Breach

A significant violation or failure to meet a contractual agreement, justifying termination of the contract by the other party.

Substantial

Of considerable importance, size, or worth; significantly large or of a degree that merits attention.

Nonbreaching Party

The party in a contractual agreement that has not failed to fulfill their obligations as set forth in the contract.

Q25: _ Owner withdrew money from the company

Q30: Daddy Warbucks is in the process of

Q43: Sales Returns and Allowances is a contra-revenue

Q73: The debit amount to Payroll Tax Expense

Q86: The bank statement shows:<br>A)the beginning bank balance

Q89: If Wages and Salaries Payable is debited,

Q97: Sue's Jewelry sold 30 necklaces for $25

Q102: Prepare the general journal entry to record

Q113: An account in which the balance is

Q127: Which of the following would not typically