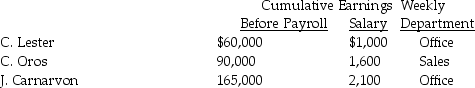

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:

Assume the following:

Assume the following:

a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Federal income tax is 15% of gross pay

c)Each employee pays $20 per week for medical insurance

Definitions:

Consumer Surplus

The gap between the price consumers are ready to pay for a good or service and the price they end up paying.

Market Demand

Represents the total quantity of a good or service that all consumers in a market are willing and able to purchase at various prices.

Music Downloads

Digital files of music tracks that can be legally or illegally downloaded from the internet to a computer or mobile device.

Sugar Quotas

Government-imposed limits on the amount of sugar that can be imported or produced, often to stabilize domestic prices.

Q43: There are 7 closing entries.

Q46: Which of the following is the most

Q51: The payroll taxes the employer is responsible

Q54: Which of the following statements about subsidiary

Q57: The use of the earned income credit

Q72: Closing entries:<br>A)need not be journalized since they

Q103: Prepare the necessary general journal entry for

Q114: If Prepaid Rent for the period is

Q117: The balance in the Wages and Salaries

Q119: The first entry to close accounts is