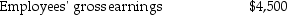

Mike's Door Service's payroll data for the second week of June included the following:

Taxable earnings for FICA:

Taxable earnings for FICA:

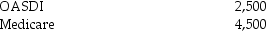

Taxable earnings for state unemployment taxes $2,000

Taxable earnings for state unemployment taxes $2,000

Assume the following tax rates:

Required: Prepare the payroll tax expense entry.

Required: Prepare the payroll tax expense entry.

Definitions:

Budgeted Required Production

The quantity of product that a company plans to manufacture in a specific period, determined based on sales forecasts and inventory targets.

Direct Labor Wage Rate

The rate of compensation paid to employees who directly work on the production of goods or services.

Raw Materials Cost

The expense incurred by a company for the raw materials that are used in the manufacturing process to produce finished goods.

Budgeted Selling Price

The price at which a company plans to sell its products or services, often used in budgeting and financial forecasting.

Q4: From the following information, prepare the bank

Q13: When the balance of the Income Summary

Q32: Which of the following sequence of actions

Q54: Rob, Bill, and Steve form Big Company.

Q63: Margo and her spouse have health insurance

Q64: Logan's Snowboards estimated depreciation for office equipment

Q64: What is the purpose of Form 8109?<br>A)Used

Q113: Payment for merchandise sold on credit for

Q115: Robert purchased a truck for $35,000 with

Q119: If cash flow is so important to