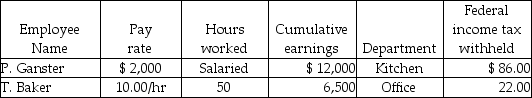

Grammy's Bakery had the following information for the pay period ending June 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable?

Definitions:

Canadian-Made Cars

Canadian-Made Cars are vehicles manufactured within Canada, showcasing the automotive industry's contributions from this country.

Stereotyping

Assuming that all members of a culture or ethnic group are alike.

Latin Canadian

An individual in Canada who originates from Latin America or whose ancestry is Latin American.

Present Orientation

The focus on current events and situations, without significant consideration for past or future implications.

Q25: Prepaid Rent is considered to be a(n):<br>A)liability.<br>B)asset.<br>C)contra-asset.<br>D)revenue.

Q38: Martin and Rachel are married and have

Q48: Choose the correct statement:<br>A)The corporate alternative minimum

Q49: Equipment with a cost of $200,000 has

Q49: Form 941 taxes include OASDI, Medicare, and

Q63: What is required of an employer by

Q93: FUTA taxes are paid:<br>A)by the end of

Q94: When making the adjustment for prepaid insurance,

Q103: The employer pays the same amount as

Q117: Prepare a bank reconciliation from the following