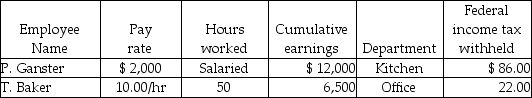

Grammy's Bakery had the following information for the pay period ending June 30:  Assume:

Assume:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Office Salaries Expense?

Definitions:

Chemical Barrier

A defense mechanism or physical substance that prevents or reduces the risk of infection or damage by biological or chemical agents.

Tears

Liquid produced by tear glands to lubricate, clean, and protect the eye surface, and can also be a response to emotions.

Lymphatic System

A part of the immune system that includes lymph nodes, lymph vessels, and organs, responsible for transporting lymph and removing toxins from the body.

Immune Response

The body's defense mechanism against pathogens, involving both specific and non-specific components.

Q2: Terry forms the Camphor Corporation during the

Q13: An employer must always use a calendar

Q17: Which form contains information about gross earnings

Q20: William and Irma have two children, Tom,

Q27: What is the purpose of the alternative

Q37: Which form is used to report FICA

Q69: The amount of FICA-OASDI and FICA-Medicare withheld

Q99: Clay purchased Elm Corporation stock 20 years

Q106: To compute federal income tax to be

Q118: What is debited if State Unemployment Tax