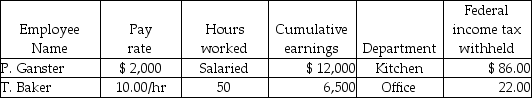

Grammy's Bakery had the following information for the pay period ending June 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

Definitions:

Lineages

Sequences of species that have evolved from a common ancestor, depicted in family trees showing evolutionary relationships.

Extrinsic Postzygotic Isolation

A reproductive barrier where offspring of two different species are viable and fertile, but external factors prevent them from thriving.

Mimetic

Relating to or involving mimicry, often used to describe organisms that imitate other species or their environment for survival benefits.

Viable/Fertile Offspring

Offspring that are capable of surviving to maturity and reproducing, indicating successful genetic compatibility between parents.

Q12: Corporations may deduct without limitation any amount

Q16: The individual employee earnings for all employees

Q20: Tax returns are processed at the IRS

Q34: Which of the following accounts would not

Q53: Sales discounts are not taken on which

Q68: The normal balance of Sales Tax Payable

Q70: J. Oros showed a net loss of

Q83: The entry to replenish a $300 petty

Q85: Which of the following accounts should not

Q88: Keith has a 2016 tax liability of