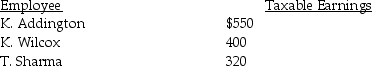

Using the information below, determine the amount of the payroll tax expense for B. Harper Company's first payroll of the year. In your answer list the amounts for FICA (OASDI and Medicare), SUTA, and FUTA.

Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 5.0% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Definitions:

Animosity

A strong feeling of hostility or antagonism towards someone or something.

Martin Delaney

An African American abolitionist, journalist, physician, and writer, known for his advocacy for black nationalism and for being one of the first proponents of African American emigration to Africa.

American Blacks

A term referring to African Americans, emphasizing their identity and heritage in the United States.

Future

The time or a period of time following the moment of speaking or writing; time regarded as still to come.

Q10: Indicate in the blank space the date

Q25: Tax return preparers must enter the annual

Q81: Ocean's Auction House's payroll for April includes

Q85: Which of the following statements is false?<br>A)Payroll

Q99: Tracey Thrasher earned $800 for the week.

Q103: Bank interest earned on a checking account

Q108: When completing a bank reconciliation, explain why

Q116: Each individual expense account is debited when

Q119: The first entry to close accounts is

Q125: Gerald is single and earns $80,000 in