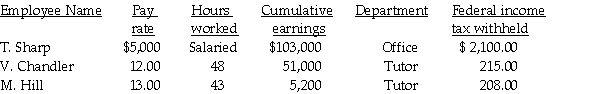

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the net pay.

Definitions:

Recognized

Acknowledged or known from one’s achievements, status, or attributes by others.

Federal Unemployment Tax

A tax imposed on employers to fund state workforce agencies. Employers pay this tax to finance unemployment compensation benefits for workers who have lost their jobs.

Form 940

A tax form filed by employers to report their annual Federal Unemployment Tax Act (FUTA) tax.

Failure to Assign Ownership

A situation where responsibilities or tasks are not clearly assigned to specific individuals or teams, often leading to confusion and lack of accountability.

Q31: A sales discount correctly taken by the

Q33: Prepare the necessary general journal entry for

Q34: The Great Gumball Corporation is a gumball

Q42: The Sapote Corporation is a manufacturing corporation.

Q43: An employee has gross earnings of $1000

Q55: Businesses will make their payroll tax deposits

Q65: Please answer the following questions:<br>a.What form is

Q65: Which of the following is false regarding

Q89: Net pay is equal to gross pay

Q97: Sue's Jewelry sold 30 necklaces for $25