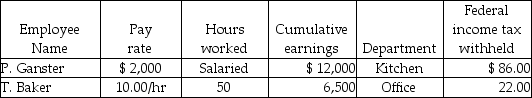

Grammy's Bakery had the following information for the pay period ending June 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable?

Definitions:

Special Project

A temporary endeavor undertaken to create a unique product, service, or result, often with specific objectives and resources.

Open Market

A system where buyers and sellers trade freely with minimal governmental restrictions, typically in reference to securities or commodities markets.

Split-off

A point in the production process where multiple products are generated from a common input.

Avoidable Cost

A cost that can be eliminated if a particular business decision is made.

Q7: To have less money withheld from your

Q21: An example of a subsidiary ledger is

Q40: During the current year, Jay is a

Q45: Which of the following will not affect

Q45: Company policy for internal control should include

Q58: The Sales Returns and Allowances account is

Q64: A partner contributes assets with a basis

Q77: Nominal accounts are called temporary accounts because

Q92: For the 2016 tax year, Sally, who

Q125: An allowance or exemption represents a certain