Essay

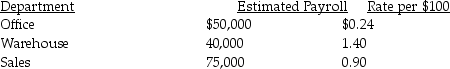

From the following data, calculate the estimate annual advance premium for workers' compensation insurance and record it in general journal form.

Definitions:

Related Questions

Q9: Losses on transactions between a partnership and

Q24: Stephanie has taxable income of $48,200 and

Q27: Daryn's cumulative earnings before this pay period

Q28: During the current year, the Melaleuca Corporation

Q55: John and Susan file a joint income

Q56: Calculate the total wages earned for each

Q58: Which of the following is not a

Q65: Rachel and Rob are married and living

Q109: The employer records deductions from the employee's

Q111: A reduction given to customers for early