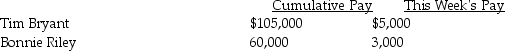

Compute the net pay for each employee listed below. Assume the following rates: FICA-OASDI 6.2% on a limit of $106,800; Medicare is 1.45%; federal income tax is 20%; state income tax is 5%; and union dues are $10.

Definitions:

Erg

A unit of energy in the centimeter-gram-second (CGS) system, equivalent to the work done by a force of one dyne exerted for a distance of one centimeter.

Basic Drive

Fundamental motivational forces that drive behavior, such as hunger, thirst, sex, and avoidance of pain.

Personality Development

The growth and change in an individual’s character and behavioral traits over their lifespan.

Cattell

Raymond Cattell was a psychologist known for his research on personality theory and his development of the 16 Personality Factor (16PF) questionnaire.

Q16: Brian Temple's cumulative earnings are $102,000, and

Q17: Richard has $30,000 of income from a

Q26: The employer's annual Federal Unemployment Tax Return

Q29: The foreign tax credit applies only to

Q36: The adjusting entry to record the expired

Q39: The change fund is what type of

Q50: Form SS-4 is:<br>A)completed to obtain an EIN.<br>B)submitted

Q61: When using a subsidiary ledger, the Accounts

Q89: If the ending balance in the Cash

Q114: Compute the total federal income tax. _