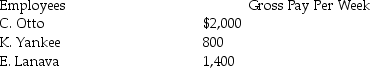

From the following data, determine the FUTA tax liability for Evans Company for the first quarter. The FUTA tax rate is 0.8% on the first $7,000 of earnings. (Assume all quarters have 13 weeks.)

Definitions:

Variable Costing

An accounting method that only includes variable production costs (materials, labor, and variable overhead) in product costs and treats fixed overhead as a period expense.

Opening Stock

The value of inventory that a company has on hand at the beginning of an accounting period.

Variable Costs

Costs that vary directly with the level of production or sales volume, such as materials and labor.

Fixed Overheads

Costs that do not vary with the level of production or sales activity, such as rent, salaries, and insurance.

Q25: Entries to customers' accounts for sales are

Q25: Prepaid Rent is considered to be a(n):<br>A)liability.<br>B)asset.<br>C)contra-asset.<br>D)revenue.

Q58: The income statement debit column of the

Q71: Which of the following is not a

Q73: Brad works at the local pizza shop

Q106: Assume Karen is 12 years old and

Q112: Prepare the necessary general journal entry for

Q114: If Prepaid Rent has been debited, it

Q118: The debit recorded in the journal to

Q119: The College Credit Card Services has a