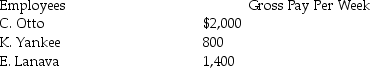

From the following data, determine the FUTA tax liability for Evans Company for the first quarter. The FUTA tax rate is 0.8% on the first $7,000 of earnings. (Assume all quarters have 13 weeks.)

Definitions:

Corporate Dividend Payout

The portion of earnings distributed to shareholders in the form of dividends.

Firm's Earnings

The profit of a company after all expenses and taxes have been deducted from revenue, indicating the company’s financial performance over a specified period.

Ex-Dividend Date

The specific date on which a declared dividend is set, after which a stock buyer is not entitled to the declared dividend.

Date of Record

This is the date set by a corporation upon which the shareholders must be on the company's books in order to receive a declared dividend or participate in corporate actions.

Q8: The revenue accounts debited and the Income

Q16: Caprice is a single 42-year-old with income

Q16: Prepare the necessary general journal entry for

Q20: When a business starts, what must it

Q57: The principal ledger containing all the balance

Q62: The "at-risk" rule applies, with limited exceptions,

Q67: On the formal income statement, the left

Q85: Which of the following accounts should not

Q95: The use of a payroll register to

Q113: Why are the employee deductions recorded as