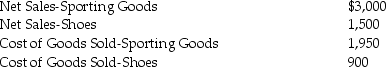

From the following partial data, prepare a departmental income statement showing income before tax along with net income for Mason Corporation for the month ended December 31.

Income Tax Rate is 30%

Income Tax Rate is 30%

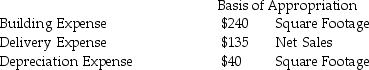

Sporting Goods Dept.-5,000 square feet

Shoe Dept.-3,000 square feet

The following items are indirect expenses and should be allocated:

Definitions:

Tax-Transfer System

The mechanism through which governments collect taxes from individuals and businesses and redistribute the revenue in the form of government spending or transfers.

Progressive

Relating to progressive policies or taxes, which are designed to have a greater impact on those who are able to pay more.

U.S. Tax System

A system governing how taxes are collected from individuals and businesses by the federal, state, and local governments in the United States, covering income, sales, property, and other taxes.

Slightly Regressive

Refers to a tax system or policy that places a relatively higher tax burden on low-income earners compared to high-income earners, but the difference is not pronounced.

Q40: Bonds discount and bonds premium are liabilities

Q44: The spreading or allocating of the cost

Q52: If Rent Expense has been debited, it

Q55: Given the income statement columns and the

Q76: The Discount Lost account is used when

Q83: If a purchase return or allowance occurs

Q87: When a bond is sold at a

Q99: Paid voucher #419 which was issued to

Q117: Isaiah Company has net income before interest

Q136: When the contract rate of interest on