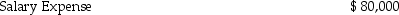

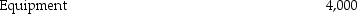

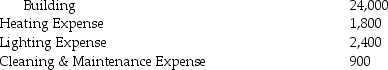

Below is a list of expenses (direct and indirect). You are to determine the total direct cost for departments A and B.

Depreciation Expense -

Depreciation Expense -

Depreciation Expense -

Depreciation Expense -

Direct cost for department A $ ________ B $ ________

Direct cost for department A $ ________ B $ ________

Definitions:

Regular Hourly Wage

This is the standard amount of money paid to an employee for each hour of work, excluding overtime rates or bonuses.

Net Pay

The amount of an employee's earnings after all deductions, such as taxes and retirement contributions, have been withheld.

Social Security Tax

A mandatory contribution paid by employees and employers to the government, intended to fund the Social Security program that provides benefits for retirees, disabled individuals, and survivors.

FUTA Tax

Federal Unemployment Tax Act tax, which is a payroll tax paid by employers to fund the government's unemployment insurance program.

Q2: When a voucher is prepared, the invoice

Q19: The twelve-month period a business chooses for

Q28: A business issues 10-year bonds payable in

Q50: The difference between a department's gross profit

Q57: Julie, a new employee, is not sure

Q59: A net income would occur if the

Q75: Indicate the effect that each of the

Q109: Post the following transaction to the ledger

Q112: Departmental income statements would not be a

Q121: Depreciation Expense would be found on which