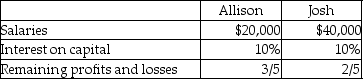

Allison and Josh are partners in a business. Allison's capital is $60,000 and Josh's capital is $100,000. Profits for the year are $80,000. They agree to share profits and losses as follows:  Allison's share of the profits before paying salaries and interest on capital is:

Allison's share of the profits before paying salaries and interest on capital is:

Definitions:

Total Revenue Variance

The difference between the actual total revenue earned and the expected total revenue in a period.

Direct Materials Price Variance

The difference between the actual cost of direct materials and the standard cost, multiplied by the quantity purchased.

Direct Labor Rate Variance

The difference between the actual cost of direct labor and the expected (or standard) cost multiplied by the actual hours worked.

Actual Quantity

The real amount of materials, labor, or overhead used in production or service delivery, as opposed to budgeted or standard quantities.

Q10: The inventory method that assumes the oldest

Q46: Mack Corporation has been issued a charter

Q59: Cash is debited when the business makes

Q60: When a stock dividend was declared above

Q63: When equipment that is fully depreciated is

Q80: A dividend is declared by:<br>A)the board of

Q92: The debit side of all accounts decreases

Q112: Alpha-Omega Industries has 30,000 shares of $12

Q116: A major disadvantage of a corporation is

Q117: Davis Corporation sells $100,000, 12%, 10-year bonds