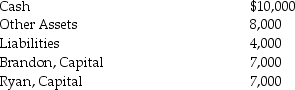

The partnership of Brandon and Ryan is being liquidated. All gains and losses are shared in a 3:1 ratio, respectively. Before liquidation, their balance sheet balances are as follows:

a)If the Other Assets are sold for $10,000, how much will each partner receive before paying liabilities and distributing the remaining assets?

a)If the Other Assets are sold for $10,000, how much will each partner receive before paying liabilities and distributing the remaining assets?

b)If the Other Assets are sold for $8,000, how much will each partner receive before paying liabilities and distributing remaining assets?

Definitions:

Tanzania

A country located in East Africa known for its vast wilderness areas, including the plains of Serengeti National Park and Kilimanjaro National Park.

Foot Impressions

Imprints left by the feet of humans or animals, which can be used in forensic science for identification or in paleontology to study ancient creatures.

Million Years Ago

A term used to date events or phenomena that occurred a specific number of million years in the past, primarily used in geology and paleontology.

Infant Mortality Rate

A statistical measure that records the number of deaths of infants under one year of age per 1,000 live births.

Q5: Greetings Online disposed of a van that

Q16: A computer server system, which had cost

Q46: Withdrawals and expenses are reported on the

Q48: A promissory note received for granting a

Q53: RH Corporation Stockholders' Equity section includes the

Q86: Sold preferred stock at a price above

Q88: Partnerships are subject to federal income tax.

Q91: Monarch Company reported Subscriptions Receivable-Common Stock of

Q102: A note that is not paid on

Q108: Empire has a credit balance of $750