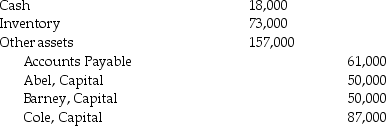

After several years of business, Abel, Barney, and Cole are liquidating. The following are post-closing account balances.

Non-cash assets are sold for $275,000. Profits and losses are shared equally.

Non-cash assets are sold for $275,000. Profits and losses are shared equally.

After all liabilities are paid, divide the remaining cash amongst the partners.

Definitions:

Financial Statement Footnotes

Detailed explanations and additional information provided at the bottom of financial statements, clarifying specific line items.

Two-Statement Approach

A financial reporting method where income tax effects of items reported outside the income statement are recognized directly in equity instead of income statement.

Unrealized Gains

Profits that have been achieved on paper from investments but have not yet been realized through selling the investment.

Other Comprehensive Income (OCI)

Income that is not included in net income, including items that are not realized or not reflected in earnings.

Q18: Soy.com Corporation has 100 shares of $100,

Q27: Which of the following types of accounts

Q31: The entry to record selling 150 shares

Q41: Deposited cash in a bond sinking fund.<br>Debit

Q78: A promissory note from the sales of

Q85: The inventory method that assumes the cost

Q116: Colo Bank accepts a promissory note for

Q122: Discuss and describe the major differences among

Q122: The Accounts Receivable account is increased by

Q128: Straight-line depreciation is used in the first